Partech Closes Second Africa Fund at €280 Million

Historic Fund Closure Amidst Challenging Times for African Startups

Partech has successfully closed its second Africa-focused fund, Partech Africa II, at a substantial €280 million ($300 million+). This milestone marks a significant achievement for the venture capital firm, solidifying its position as the largest fund dedicated to supporting African startups. The closure comes just one year after reaching its first close and is all the more remarkable given the challenging market conditions.

Rising Challenges in Africa’s Venture Capital Landscape

The past year has seen a notable decline in investor activity on the continent, with a 50% decrease in 2023 compared to the previous year. According to a recent report by Partech, this downturn is largely attributed to global economic shifts and local challenges. As a result, venture capital inflows for African startups decreased significantly, totaling between $2.9 billion and $4.1 billion last year, down from $4.6 billion to $6.5 billion in 2022.

Impact on Investment Stages

The decline in investor activity had far-reaching consequences across various investment stages. Seed-stage deals decreased by a staggering 33%, while growth-stage deals plummeted by 39% according to Partech’s findings. While Partech Africa, known for leading rounds, cannot single-handedly reverse this trend, its focus on supporting startups from seed to Series C rounds may offer some stability and support during these challenging times.

Strategic Approach

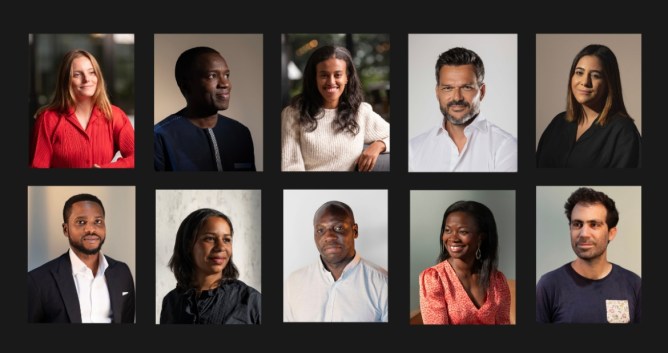

Partech Africa’s General Partners emphasized the importance of their approach in supporting founders at various stages of their journey. "The capacity to anchor rounds at all stages from seed to early growth is more critical than ever," said Cyril Collon. The firm’s expanding team will enable effective deployment of capital and offer assistance to portfolio companies across these stages.

Regional Focus

With offices in Dakar, Nairobi, and Dubai, Partech Africa has established a presence in Lagos, where it is actively hiring to engage closely with startups in the region. This strategic expansion underscores the firm’s commitment to supporting African startups on their growth journey.

Continued Investor Interest

Despite the challenging market conditions, Africa-focused funds continue to attract significant investor interest. Recent closures include Partech doubling the size of its African venture fund to $143 million, reflecting continued confidence in the region’s growth potential.

Key Takeaways:

- Partech has successfully closed its second Africa-focused fund at €280 million.

- The market conditions remain challenging for African startups, with a decline in investor activity and reduced venture capital inflows.

- Partech’s focus on supporting startups from seed to Series C rounds may offer some stability during these times.

- The firm’s strategic approach emphasizes the importance of anchoring rounds at all stages.

Sources:

- Partech report on Africa-focused funds

- TechCrunch article on Partech’s fund closure

- Venture Capital landscape in Africa

Recommendations:

- African startups should focus on building strong relationships with investors and be prepared to adapt to changing market conditions.

- VC firms like Partech can play a crucial role in supporting startups through these challenging times by offering guidance, resources, and network connections.

This comprehensive report highlights the challenges faced by African startups, the strategic approach of Partech Africa, and the continued investor interest in the region. By understanding these dynamics, stakeholders can better navigate the complex venture capital landscape and support the growth of African startups.