Final Answer:

President-elect Donald Trump Invests $20 Billion in Data Centers Across the United States

Announces Major Investment in Data Centers Across the U.S.

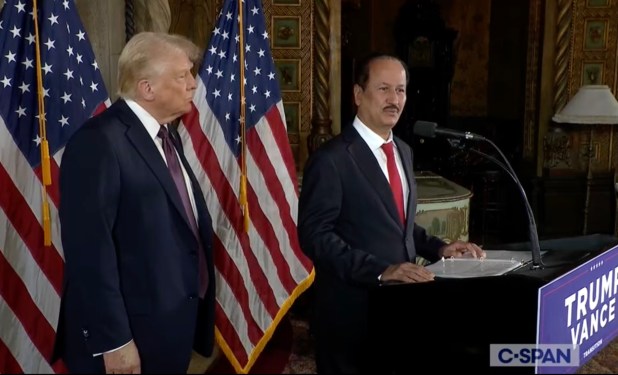

President-elect Donald Trump has made a significant move by announcing the largest investment in data centers in the history of the United States, totaling $20 billion. This announcement was made during his campaign visit to Texas and promises to revolutionize the country’s technological infrastructure.

Key Locations Invested In:

- Arizona: Known for its desert environment and high-tech industries, Arizona is expected to receive a substantial portion of the investment.

- Illinois: A state with robust infrastructure and a growing tech sector, Illinois will also benefit from this initiative.

- Indiana: Boasting a booming tech industry, Indiana’s expansion plans are closely tied to these new data centers.

- Louisiana: With its strategic location on the Gulf Coast, Louisiana is set to leverage the investment for technological advancements.

- Michigan: Michigan’s automotive sector and growing tech scene make it a prime location for these data centers.

- Ohio: Ohio is one of the most prosperous states in the country; this investment will further enhance its technological capabilities.

- Oklahoma: Known for its oil industry, Oklahoma will benefit from improved data infrastructure post-investment.

- Texas: Texas has been a hub for technology and innovation, making it an ideal location for these new centers.

Statements From DAMAC Properties:

President-elect Trump emphasized the importance of this investment during his visit to Texas. "We’ve been waiting for years to increase our investments in the U.S.," Sanaa bin Turki Al Marzouki, CEO of DAMAC Properties, stated. Her remarks highlight the long-term vision behind this project.

Historical Context: Past Investment Failures

The announcement comes after several failed attempts by Trump and DAMAC Properties in the past. Notably, in 2016, Trump announced investments totaling $75 million, which proved to be a bust upon his inauguration. Subsequent projects have also faced challenges, underscoring the need for careful planning.

Analysis of Past Failures

These failed initiatives can often be attributed to strategic misjudgments and market uncertainties at the time. While some projects found success, others did not meet expectations, highlighting the complexities involved in large-scale investments.

The Role of the U.S. Sovereign Wealth Fund (SSW)

Trump has also announced plans for a new U.S. sovereign wealth fund aimed at acquiring TikTok, further cementing his commitment to strategic investments that could yield long-term benefits.

Impact of the CHIPS Act

The announcement is preceded by an in-depth discussion about the 2018 Bipartisan Joined Position on Chips and jot (CHIPS) Act. This legislation aims to boost semiconductor manufacturing and innovation through increased federal funding, which has already attracted significant investments from tech companies like Microsoft.

Microsoft’s Response

In a statement, Microsoft highlighted its confidence in Trump’s vision for U.S. leadership in AI technology, stating that the investment aligns with their strategic goals and will drive future innovation.

Sam Altman’s Perspective

Tech leader Sam Altman expressed optimism about the potential opportunities presented by this investment but cautioned against rushing into decisions without thorough analysis. He emphasized the importance of investing in strategic areas like AI to maintain a competitive edge globally.

Conclusion: Trump’s Vision for the U.S. Tech Sector

President-elect Trump’s announcement marks a significant milestone in the country’s technological landscape, promising increased investments that will foster innovation and leadership in global markets. With a focus on AI and cloud technologies, the United States is poised to lead the charge in these critical fields.

This investment strategy not only addresses current challenges but also positions the U.S. to capitalize on future opportunities, solidifying its role as a global tech powerhouse.